Government

Members of Congress, Mr. President and Vice President

On the heels of a pandemic, our country endured one of the worst societal disruptions in its history. COVID’s direct and indirect effects have taken the lives of over one million Americans, bankrupted businesses nationwide and further amplified many of the economic imbalances that have eroded our culture for decades. The 2020 and 2022 elections not only reflected a deep desire to return to normalcy, but to build everything back better than it had been before the pandemic.

Following President Biden’s election, much progress was made on his promise to pursue that objective, but some of the most critical parts have languished, particularly those addressing human infrastructure and climate change, in spite of the record levels of support for them found in the Infrastructure Investment and Jobs Act1 of 2021 and the Inflation Reduction Act of 20222 (IRA).

This site lays out a strategy on how we, the citizens of the United States, can tackle many of those problems ourselves, without having to rely on the federal government to do it for us, nor on the taxpayer to finance it—principals both parties can applaud.

What & How

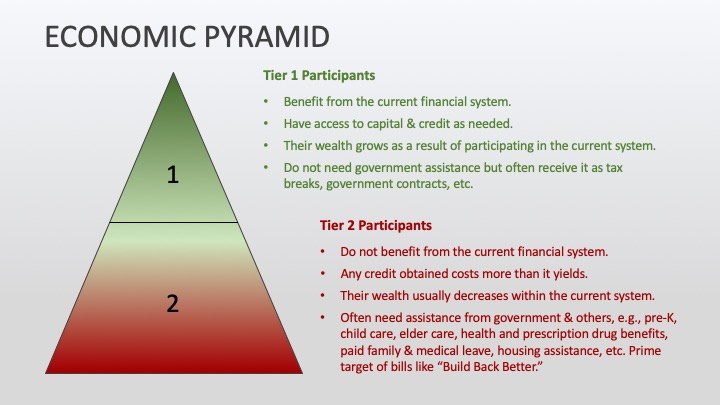

Many of today’s challenges can be traced to growing income and wealth disparity. Lack of money is at the root of many seemingly unsolvable societal problems. Historically, communities have looked to the federal government to address that lack, on the assumption that all money comes from the government.

The reality is that the government is not the only entity allowed to issue money. We private citizens and businesses can too, and throughout U.S. history, we often have, according to this 2008 article published by the Federal Reserve Bank of Cleveland titled Private Money in our Past, Present, and Future..3

“Who is allowed to issue money in the United States? The founding fathers made it clear that the power to create money would not be taken lightly. Their experiences with money and inflation during the Revolutionary War made them wary of paper money and conscious of the power wielded by those authorized to create it. They gave Congress the right to issue money and forbade the states from doing so. But the federal government isn’t the only entity that has, in practice, issued money. Private citizens and private companies have, too. . .”4

And therein lies a key to helping address the scarcity of money in the productive economy. The government calls money issued by private parties “virtual currencies”. As citizens of the United States, we can issue our own money as a virtual currency and use it to solve the kinds of problems listed below and more. This is not to be confused with cryptocurrencies (a form of virtual currency issued by private parties) which are driven by profit making objectives. The kind of virtual currencies we advocate for are ones designed to uplift all members of society and not just make some people wealthy, although they are primarily intended to aid those less fortunate than others, as described next.

And there is strong historical evidence that money issued by the people can have a dramatic and positive impact on local economies. Examples of successful local currency programs can be found throughout history. One of the most notable was in Europe during the Great Depression where the small Austrian town of Wörgl issued its own money called stamp scrip (a common form of currency also used throughout the U.S.). That effort was so successful in lifting the town’s economy that it became known as the Miracle of Wörgl.

Hundreds of communities across Europe flocked to Wörgl to learn the secret. Professor Irving Fisher, a leading U.S. economist, studied the Wörgl experiment and told FDR’s administration that “The correct application of stamp scrip would solve the Depression crisis in the U.S. in three weeks.” Even though it was determined that he was correct, no action was taken. (See the full Wörgl story, Fisher’s story and more here.)

The key for all of us is that we can apply the methods used in Wörgl and elsewhere to break free from the stranglehold that the current financial eco system has over us and create a new paradigm outside of its control and influence. We can look to the futurist Buckminster Fuller’s aphorism that “You never change things by fighting the existing reality. To change something, build a new model that makes the existing model obsolete.”

Who is this intended to help?

Examples of What Can be Done with Citizen-issued Money

|

Job creation programs |

Fully funded K – post secondary education |

Solvent state & local governments |

|

Startup grants |

Fully funded pre-K programs |

Pension plans fully funded |

|

Basic income grants |

Healthcare for all |

Renewable energy programs |

|

Small business grants & loans |

Day care for children & elderly |

Blight remediation programs |

|

Full employment & living wages |

In-home care for children, elderly & infirm |

Clean air & water |

|

Student grants & loans |

Paid family leave |

Sustainable local agriculture |

|

Tuition-free colleges, vocational & entrepreneurship training |

Elimination of homelessness |

Food grant programs |

|

Elimination of student debt |

Elimination of foreclosures |

So, what stands in the way of communities using these concepts to lift themselves up economically? The answer is certain IRS regulations, explored here.